Consolidate, enrich and activate sales, product and customer data

Power to the Marketer

We empower marketers to build, launch, and scale personalized cross-channel campaigns that drive business outcomes.

The customer engagement platform trusted by leading brands

and innovative marketers across the globe

The omnichannel customer engagement platform built to accelerate business outcomes

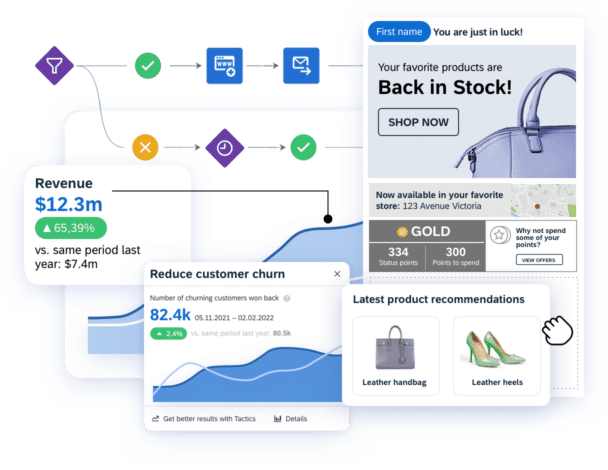

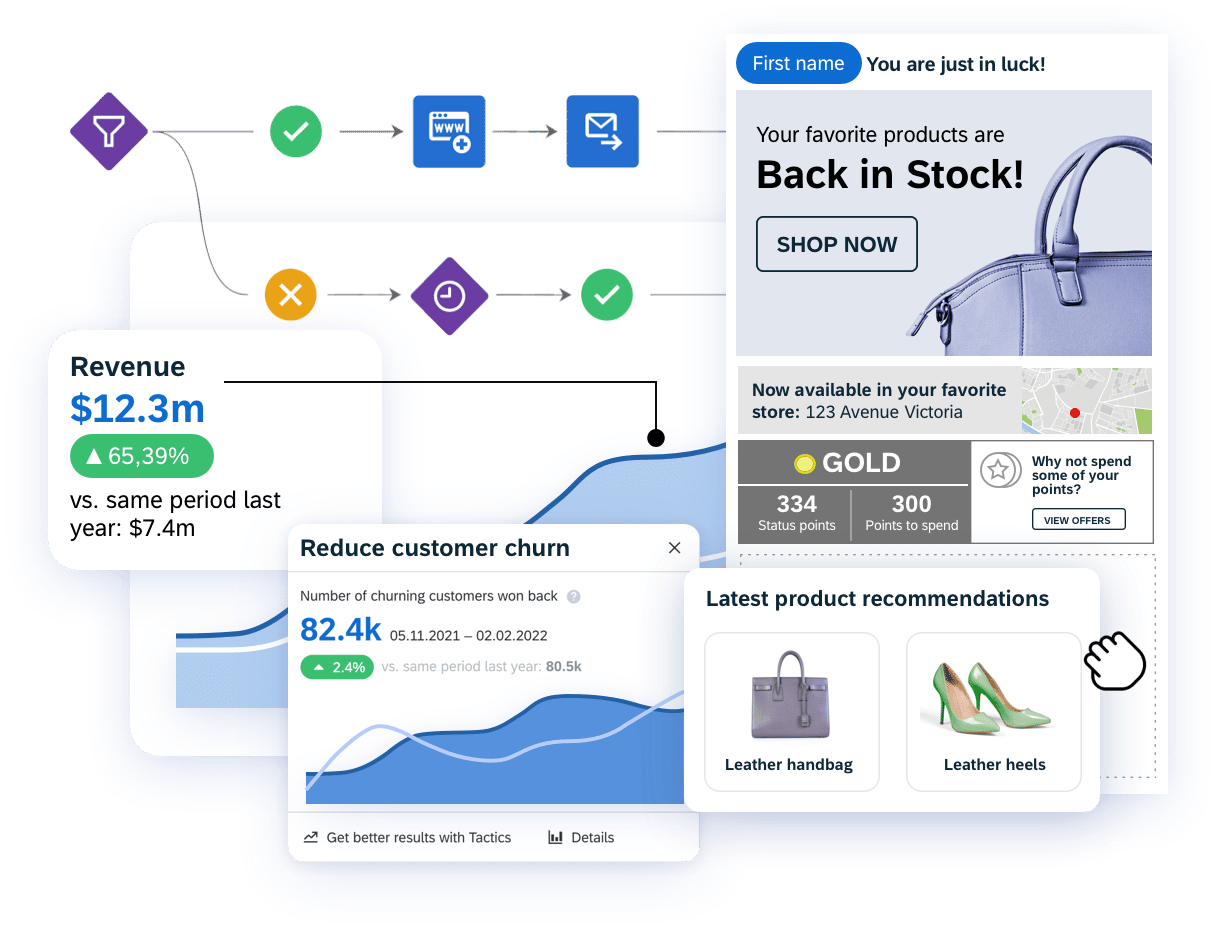

Integrated Data Layer

Personalization Engine

Engage your customers with intelligent personalization, using data and AI

Marketing Automation

Launch integrated campaigns across channels with speed and agility

Cross-Channel Execution

Reach customers across email, web, mobile, ads, and more

Customer Lifecycle Management

Accelerate business outcomes across the lifecycle and drive loyalty

Intelligence & Analytics

Make smart, quick decisions with AI and data-driven insights

Strategies & Tactics

Deploy pre-built, customizable multi-channel campaigns

Omnichannel Integrations

Enhance personalization across every touchpoint with integrated solutions

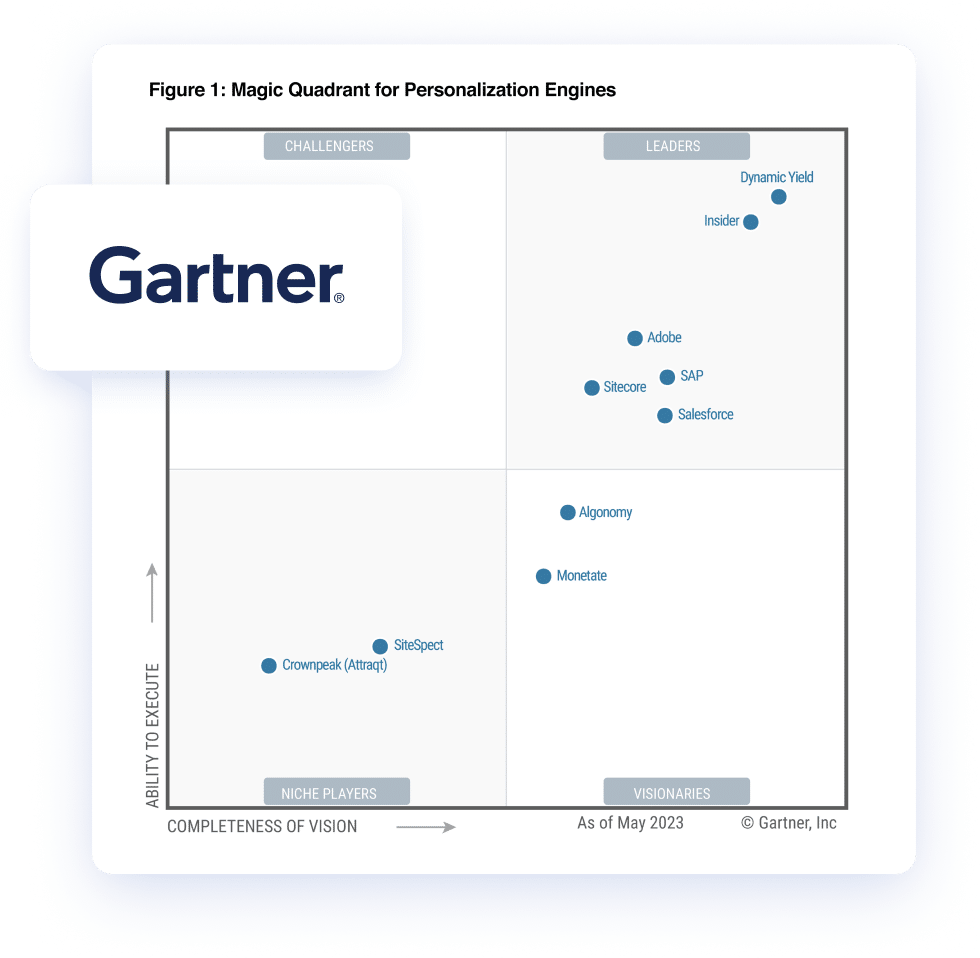

We’re a Leader Again in Personalization

2023 Gartner® Magic Quadrant™ for Personalization Engines

Engage with the latest from the industry

FEATURED CONTENT